Trade the world with Stock CFDs

Everything you need to know about stock CFDs

How to get started trading stock CFDs

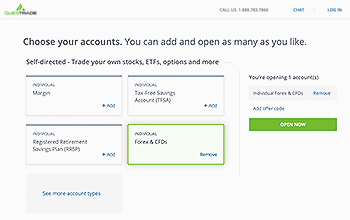

Open an account

To get started you need to open a Forex and CFD account.

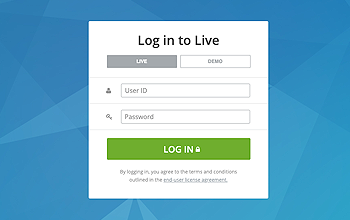

Log into the platform

When your account is open, you can trade stock CFDs on the

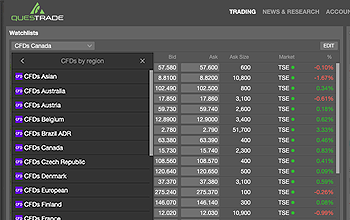

Find stock CFDs by country under watchlists

Pricing of stock CFDs depend on the country the underlying stock trades on. For a full list of stock CFD commissions and fees, see pricing

Get answers to frequently asked questions

On top of a commission, you may also incur financing fees and borrowing fees. Learn more

Trading on margin means you’re borrowing money from a broker to purchase a security. Learn more

This rate varies by country. For more details, see the Trading with margin page.

Questrade offers a wide variety of global markets. For a full list, go to the FX & CFDs pricing page.

To trade stock CFDs, you need to open a Forex & CFD account. Once the account is open, you can trade them on the award-winning platform, Questrade Global.