Lesson Mortgage affordability and down payment

How much do I need for a down payment as a first-time home buyer?

Learn the common down payment options when you're purchasing a home.

- How much is a typical down payment?

- Do I need mortgage default insurance?

- What are my options if I don’t have 20% of my down payment saved?

With housing prices on the rise across Canada, one of the most common questions first-time home buyers ask is, “Do I have enough money for a down payment?” We’re here to help answer that question and explore the options available to you to help you become a homeowner sooner.

What is a down payment?

Let’s start with the basics. A down payment represents a percentage of the total cost of your home that you pay up front and does not come from a mortgage lender.

If you’ve been saving up for a down payment, then you’ve likely heard of the 20% down rule. This conventional wisdom recommends putting down 20% of the overall cost of the home as a down payment.

Doing so offers many benefits, such as eliminating the need to buy mortgage default insurance. However, saving 20% for a down payment is a significant financial feat, especially in large cities like Toronto, Montreal, and Vancouver. With the average home in Canada now costing upwards of $500,000, a $100,000 down payment (20% of $500,000) may not be an attainable goal for many.

How much is a typical down payment?

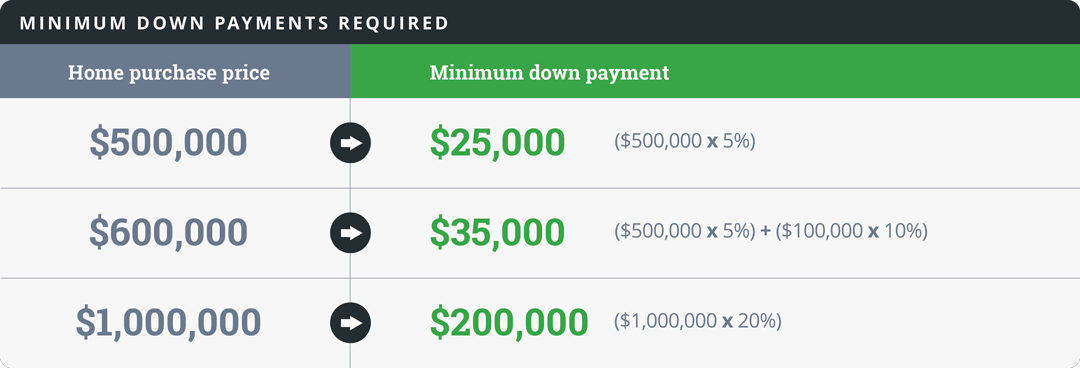

Real estate prices in Canada have been on the upswing, meaning the typical size of a down payment has also increased. The minimum down payment in Canada is 5%, but the amount of a typical down payment will depend on the price of the house you’re looking to buy. Here’s an outline of what’s legally required as a down payment for guidance.

- $500,000 or less – 5% of the purchase price

- $500,000 to $999,999 – 5% of the first $500,000 and 10% of the purchase price above $500,000

- $1,000,000 or more – 20% of the purchase price

Here are a few examples of the minimum down payment required for different purchase prices.

These figures are specific to owner-occupied properties and are different for multi-unit or rental properties.

What’s mortgage default insurance?

Mortgage default insurance protects the lender if the borrower defaults on the mortgage. It is required on all mortgages with down payments of less than 20% (known as high-ratio mortgages) where the value of the property is less than $1,000,000.

There are three mortgage default insurance providers in Canada: Canada Mortgage and Housing Corporation (CMHC), Genworth Financial Canada, and Canada Guaranty. Learn more.

What are my options if I don’t have the 20% down payment?

If you don’t have the 20% down payment, it’s not a problem. There are a few options available to you that can make homeownership more affordable.

1. Purchase a home with less than 20% down

In today’s market, it’s absolutely possible to purchase a home with less than 20% of the purchase price and many Canadians do so. Purchasing a home with mortgage default insurance allows you to enter the market quicker to start gaining equity.

2. Open a First Home Savings Account (FHSA) and focus on saving

If you’re saving for a down payment, you can start early by opening an FHSA account and start saving. With an FHSA, you can contribute an annual tax-deductible amount of up to $8,000 with a lifetime contribution maximum of $40,000 per person for a home purchase. What’s great about an FHSA is that your contributions are tax deductible and any qualifying withdrawals from the account for a home purchase are tax-free. To learn more, please check our helpful article here.

3. Take advantage of the first-time home buyer program in Canada

Luckily, there is a first-time home buyer program in Canada that you can check out that can make homeownership more affordable. The Home Buyers’ Plan allows you to withdraw up to $60,000 tax-free from your RRSP (Registered Retirement Savings Plan) when you purchase your first home.

4. Buy with a partner or friend

Having a co-applicant can make the mortgage buying process easier. If you feel comfortable, you could have a chat with a partner or close friend about homeownership. In expensive markets, the more creative you can be – the better.

5. Ask a relative for support

In some situations, it could be worthwhile to ask a relative and see if they can help with the down payment. A gift from an immediate family member can go a long way.

As you can see, putting 20% down for your first home is an impressive financial achievement. However, it is simply not attainable for everyone in today’s market. If you’ve already started saving for a down payment, it could be helpful to check our rates page to see what kind of rate you could qualify for.

Already put an offer in on a house? Start your application with QuestMortgage and see what rate you could qualify for. Get my rate.

The information in this blog is for information purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Questrade Group of Companies, its affiliates or any other person to its accuracy.

Ready to get started?

In just a few clicks see our current rates, then apply for a mortgage in minutes!

Related lessons

Read next

Preparing for mortgage financing

Ready to take the next step to homeownership? Read our articles to get you started.

View lessonExplore

Mortgage 101

Ready to take the next step to homeownership? Read our articles to get you started.

View lessonThe information in these resources are for information purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Questrade Group of Companies or any other person to its accuracy.

Rates for high ratio insured mortgages are only available for customers purchasing an owner occupied residential property valued at under $1,000,000 with less than 20% down payment, and who are eligible for mortgage default insurance.

The interest rate is guaranteed for up to 120 days from the date the application is approved. If the mortgage is not funded within 120 days from the date the application is approved, the interest rate guarantee expires.