Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied, is made by Questrade, Inc., its affiliates or any other person to its accuracy.

Lesson Advanced Investment tools

Questrade Edge Desktop screener

Learn more about the screener tool available in our Edge Desktop trading platform. Screeners allow you to search for Stocks, ETFs, Options and other securities that meet your criteria.

The screener window lets you scan the market for stocks, options, and indices that meet specific criteria such as price, volume, volatility, and many other financial metrics.

You can also conduct research for securities and find trading opportunities that are sometimes difficult to spot. Then, you can screen further by customizing your results using a variety of filters and sorting options.

The screener window also allows you to:

- Open multiple, popular, pre-set screens to rank stocks and options based on volatility, volume, trading activity, open interest and much more

- Select a screening universe to filter by stocks, options, indices, ETFs, securities categorized by sector and industry, or securities in your watch lists

- Select pre-set column views to display screening results

- Add additional filters to narrow your search results

- Save your favourite screeners with the filters that interest you the most so they’re waiting for you on the platform

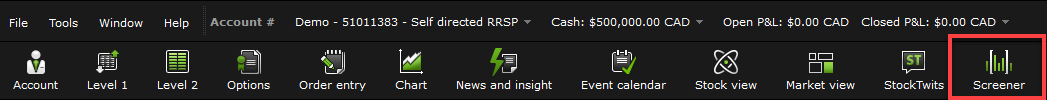

To access the screener, head over to the top navigation panel and click on the Screener icon. Alternatively, you can access it via Tools > Screener.

Customizing your screener

There are multiple ways you can customize the screener tool depending on the criteria you’re looking for.

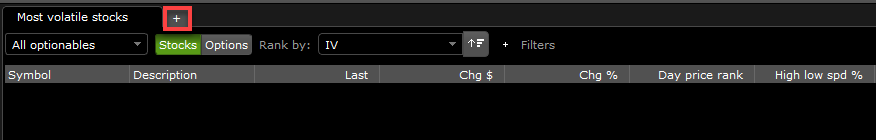

But first, let’s add a customizable screener. To do this, simply click the + button on the top navigation bar beside the Most volatile stocks tab (default tab). Alternatively, you can right-click on any part of the screener window and choose New custom screen.

Once added, you can customize the following sections to customize the screener tool:

Please note: The information prepared in this section is for educational purposes only, and should not be taken as any form of trading or investment advice.

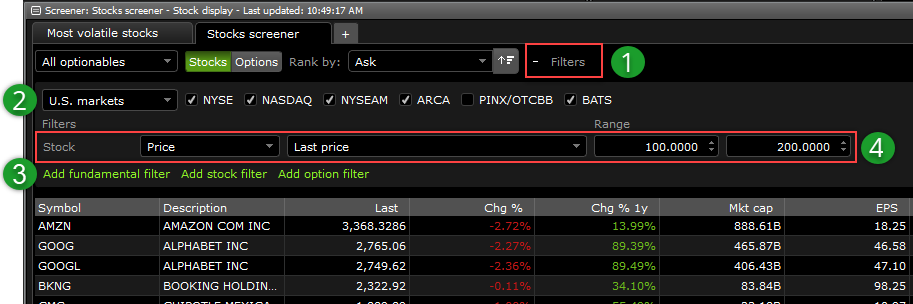

- Filter drop-down menu. Clicking this menu opens up other filters such as market and stock filters. To the left of it, you have the Rank by menu to rank the securities based on your preferences, Stocks and Options tab, and an aggregate list that includes All symbols, All stocks, All ETFs, and much more.

- Market selection. Here, you can pick the market (Canadian, U.S, or all markets) you wish to look at and narrow it down by exchanges.

- Filter selection. The following selection adds a filter to your screener including fundamental, stock, or option filter.

- Filter options. Once you’ve added a filter of choice, you can customize them including a range selection (for each) depending on your criteria.

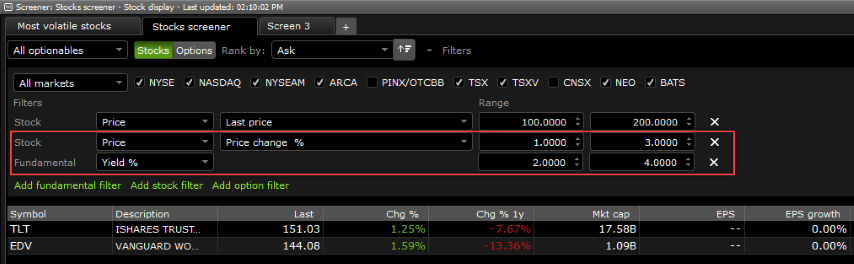

If you wish to narrow your search, you can simply add more filters. Below is an example of adding another stock filter for price change %, and a fundamental filter for yield %.

Once you’re satisfied with the filters, you can click Apply to make your custom screener.

Your custom screener can display up to 200 symbols (or minimum 10) each time. For each screener, you can also add or remove columns by right-clicking on any part of the screener window and choose Edit columns.

Please note: If you set up your screener before market hours for stocks and options, the screener will display the previous closing price and IV (and greeks and other metrics for options).

Related lessons

Want to dive deeper?

Level 2 trading quotes

Get a comprehensive overview of level 2 data, the information it can provide and how it can impact your trading.

View lessonRead next

Introduction to options trading

Get a comprehensive introduction to trading options, how they work and answers to common questions and terminology.

View lessonExplore

Investment tools at Questrade

Learn more about the tools available through our API Partners to unlock new research, trading, and portfolio optimization capabilities.

View lesson